The Risks of Hyper-Concentration: Volatility Drag and the Probability of Sub-5% Returns

While some prominent investors, like Warren Buffett, advocate for highly concentrated portfolios, believing diversification is unnecessary for those who “know what they are doing”, academic research and empirical evidence suggest the opposite.

Nobel Prizes in financial economics have been awarded for research based on diversified portfolios, forming the bedrock of multi-trillion-dollar firms like Vanguard and BlackRock. Evaluating these competing claims, simulations, and historical data reveals that extreme concentration significantly increases risk and decreases expected returns, largely due to a phenomenon called volatility drag.

Related reading: – Risk Parity Position Sizing

What Is Volatility Drag?

Volatility drag is a direct negative impact on returns caused by portfolio swings. It illustrates that linear changes in volatility lead to squared losses in total return.

For instance, a portfolio that drops 10% in year one and rises 10% in year two has actually lost 1% of its value. Similarly, a 20% drop followed by a 20% gain results in a 4% loss, and a 30% drop followed by a 30% gain leads to a 9% loss. These “extreme swings” are much more likely to occur in hyper-concentrated portfolios, making diversification an easy way to reduce idiosyncratic risk.

The argument that portfolio managers should leave diversification to allocators is flawed because volatility drag affects every concentrated manager, according to a recent weekly research by Verdad Weekly Research.

Consequently, even if individual manager strategies are uncorrelated, their expected returns are inherently lower due to their hyper-concentration. This means institutions like endowments and foundations are more likely to fall short of their necessary return thresholds when allocating to such managers.

The Risk of Falling Below a 5% Net Annualized Return

A real measure of risk, even for patient investors, is the probability of return shortfall. For a foundation needing to pay out 5% of its assets annually, generating an annualized portfolio return above 5% (net of fees) is crucial to avoid a shrinking asset base. Failing to meet this threshold over a long period, such as 10 years, can materially reduce the foundation’s ability to fund its mission.

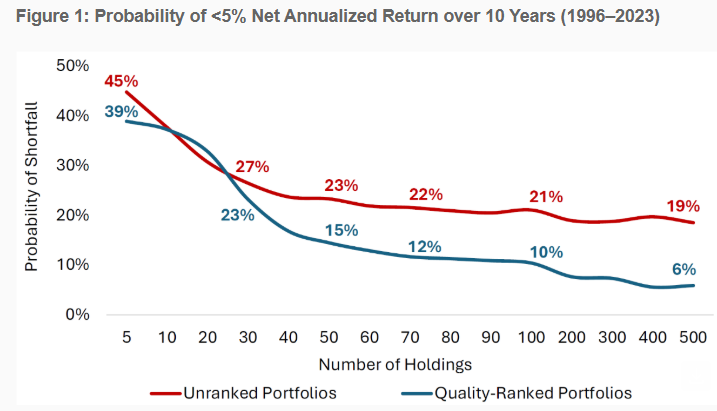

To quantify this risk, Verdad Research wrote a compelling article called Total Concentration. Simulations were conducted using data from US stocks (S&P Capital IQ) between 1996 and 2023. 10,000 manager portfolios were simulated at varying levels of concentration, from 5 stocks to 500 stocks, over a 10-year horizon with annual rebalancing.

The simulations also accounted for typical active hedge fund fees (1.5% management fee and 20% carry above an 8% preferred return). The probability of shortfall was defined as the percentage of 10-year outcomes falling below a 5% net annualized return.

The Findings Highlight A Significant Risk

Hyper-concentration substantially increases the risk of underperforming the 5% target. Unranked portfolios (where holdings are selected randomly) with 5–10 stocks had approximately a 40% chance of returning less than 5% annualized over 10 years.

In contrast, the shortfall risk for unranked portfolios with more than 50 stocks was roughly 20%, with the probability stabilizing around 50 stocks up to 500 stocks. This demonstrates that hyper-concentration doubles a manager’s risk of missing the 5% minimum return target.

The Impact of Quality Ranking and Fees

The simulations also explored the effect of combining concentration with a quality ranking system (selecting stocks based on profitability and free cash flow generation).

- While quality ranking generally offers risk-reduction benefits to diversified portfolios (8–13 percentage points lower probability of shortfall for portfolios with more than 50 quality stocks), these benefits largely disappear in hyper-concentrated portfolios.

- 5–10 quality stocks exhibited about the same 40% probability of shortfall as unranked portfolios of the same concentration.

- The reason for this diminished benefit is that volatility drag offsets the return premium from factor exposure. Hyper-concentrated portfolios with 5–10 of the highest-ranked stocks actually had lower gross returns than diversified portfolios of 50 or more stocks.

- Hyper-concentrated unranked strategies trailed diversified portfolios by more than a percentage point.

- Hyper-concentrated quality strategies underperformed diversified quality portfolios by 1–2 percentage points, despite consistently rebalancing into higher-ranked stocks.

- When measuring the quality premium (excess gross return relative to the 10% market return), volatility drag more than offsets the benefits of quality exposure among hyper-concentrated portfolios, causing them to underperform the market on average.

The situation worsens after accounting for fees. Hyper-concentrated portfolios trailed their diversified peers by 1.5–2.5 percentage points on average. Diversified quality-ranked strategies returned 8–9% net of fees, while unranked diversified portfolios returned around 7.5% net of fees, on average, with expected returns stabilizing after about 50 stocks.

Survivorship Bias and Predictive Accuracy

Beyond direct return impacts, hyper-concentration contributes to other risks:

Survivorship Bias: Hyper-concentration mechanically increases the dispersion of returns. This leads to “eye-popping returns” for a few lucky winners, who gain publicity and attract fundraising, while the majority of “unlucky losers quietly go out of business”.

Studies of actual mutual funds confirm this, showing that concentrated portfolios have worse outcomes on average and significantly higher fund death rates. The most concentrated mutual funds were 2-3 times more likely to close or liquidate within three years of launch.

Illusion of Control/Predictive Accuracy: Arguments for concentration often cite “conviction” and the allocation of “mental capital” to thoroughly understand a few holdings.

However, research indicates that neither doing more work nor having higher conviction leads to better predictive accuracy. There’s a fundamental separation between understanding current events and predicting future ones; no human can predict the future, and a deep understanding of a company doesn’t guarantee against negative surprises.

This means the “skill” burden on managers of hyper-concentrated portfolios to outperform is considerably higher (around five percentage points of value-add to beat the market by 1% annualized), compared to diversified portfolios (3–4 percentage points).

In conclusion, the evidence strongly suggests that diversification offers “free benefits” and a more reliable path to long-term wealth building, especially for investors who acknowledge the limits of human foresight.

Hyper-concentration, on the other hand, dramatically increases the risk of falling short of critical return targets like 5% due to volatility drag and other related factors