Lumber/Gold Ratio Trading Strategy For Stocks And Bonds (Rules, Backtest, Performance)

In May 2015, Micheal A. Gayed published a paper called Lumber: Worth Its Weight in Gold Offense and Defense in Active Portfolio Management (free download at SSRN). We used that paper to make a profitable lumber/gold ratio trading strategy for stocks and bonds.

Let’s explain the strategy’s reasoning, trading rules, backtest, performance, and results.

Key takeaways

- Strategy Origin: The strategy is based on a paper published in May 2015 by Michael A. Gayed, titled Lumber: Worth Its Weight in Gold Offense and Defense in Active Portfolio Management. The authors of this article used Gayed’s paper to develop a profitable lumber/gold ratio trading strategy.

- Lumber as an Indicator: Lumber futures are considered a leading indicator of economic growth because housing and construction are significant components of the business cycle and housing greatly influences consumer spending. Housing permits are also a key leading economic indicator in the U.S.. Therefore, lumber futures can provide an early warning of a recession or economic boom.

- Gold as a Diversifier: Gold is incorporated into the ratio due to its unique asset class properties. It has a historical role as a store of value and exhibits low correlation with other asset classes, including equities, bond indices, and macroeconomic variables like GDP, inflation, and interest rates. This makes gold valuable for diversification and hedging against risk. Micheal Gayed created the lumber/gold ratio to serve as a risk on/risk off (RORO) indicator.

- Michael Gayed’s Trading Rules:

- Gayed’s rule combines cyclical lumber with non-cyclical gold to inform when to “play offense” (invest aggressively) or “play defense” (invest defensively).

- Using weekly data, the rule is:

- If Lumber outperforms Gold over the prior 13 weeks, take a more aggressive stance in the portfolio for the following week (invest in stocks).

- If Gold outperforms Lumber over the prior 13 weeks, take a more defensive stance in the portfolio for the following week (invest in long-term Treasuries).

- The 13-week timeframe aligns with research showing strong commodity momentum in the 3-month period.

- QuantifiedStrategies.com’s Modified Trading Rules:

- The authors of the article modified Gayed’s rules.

- Their rules are:

- Make a lumber/gold ratio.

- When the ratio is higher than the month before, go long S&P 500 (SPY).

- When the ratio is lower than the month earlier, go long bonds (TLT).

- They used WOOD as a proxy for lumber and GLD for gold.

- Backtest Performance (Modified Rules):

- The strategy, rotating between SPY and TLT, showed good results with 11.4% annual returns since 2008 and an average gain per trade of 2.2%.

- However, it experienced a significant 35% drawdown in 2022/23 due to the bond market collapse.

- The article concludes that despite the high average gains, most traders would likely abandon the strategy with such a large drawdown, as “keeping faith in a rotation trading strategy with such a drawdown is hard”.

- An alternative rotation between SPY and GLD performed significantly worse, yielding only 8.7% annual returns

Lumber as a cyclical indicator

You might wonder, why lumber?

Gayed explained it like this:

Lumber futures are often overlooked as a leading indicator of economic growth, but they may be just as important as industrial metals like copper.

Housing and construction are significant components of the business cycle, and housing greatly influences consumer spending and is the primary store of wealth for most Americans. Unsurprisingly, housing permits are one of the key leading economic indicators in the U.S., ranking ahead of the S&P 500 in their ability to signal a turn in the economy.

In other words, lumber futures may be a valuable tool for investors and policymakers who want to get an early warning of a recession or economic boom.

Why is gold mixed with lumber?

Micheal Gayed argues:

Gold is a unique asset class because of its historical role as a store of value and its low correlation with other asset classes. This makes it a valuable tool for investors looking to diversify their portfolios and hedge against risk.

Previous research indicates no statistically significant correlation between returns on gold and changes in macroeconomic variables such as GDP, inflation, and interest rates.

Additionally, returns on gold are less correlated with returns on equities and bond indices than those on other commodities. This means that gold can provide diversification benefits for investors who have already invested in stocks and bonds.

Cash is another asset class that investors often use for diversification. However, cash has more consistent counter-cyclical properties in bear markets or contractionary economic environments. This means that cash tends to hold its value better than other assets during economic downturns.

Gold is a unique asset class that offers investors several benefits, including diversification, low correlation with other asset classes, and a historical role as a store of value.

Hence, Michael Gayed made a lumber/gold ratio to predict and use it as a risk-on/risk-off (RORO) indicator.

The Lumber-Gold Trading Rule made by Micheal Gayed

The trading rules used in the paper are like this (quoted directly from Gayed’s paper):

- Combining cyclical Lumber with non-cyclical Gold provides vital information on when to “play offense” and when to “play defense” in an investment portfolio.

- Using weekly data available on Lumber and Gold going back to November 1986, we developed

the following trading rule: - If Lumber outperforms Gold over the prior 13 weeks, take a more aggressive stance in the portfolio for the following week.

- If Gold outperforms Lumber over the prior 13 weeks, take a more defensive stance in the portfolio for the following week.

- Re-evaluate weekly and make changes to the portfolio only when leadership between Lumber and Gold changes.

- Research has shown that commodities exhibit momentum in various time frames from 1 month through 12 months, with the strongest momentum exhibited in the 3 month period. Three months equates to 13 weeks, which is the timeframe used in this paper.

When it was “risk on”, Gayed was invested in stocks. When it was “risk off”, he was invested in long-term Treasuries.

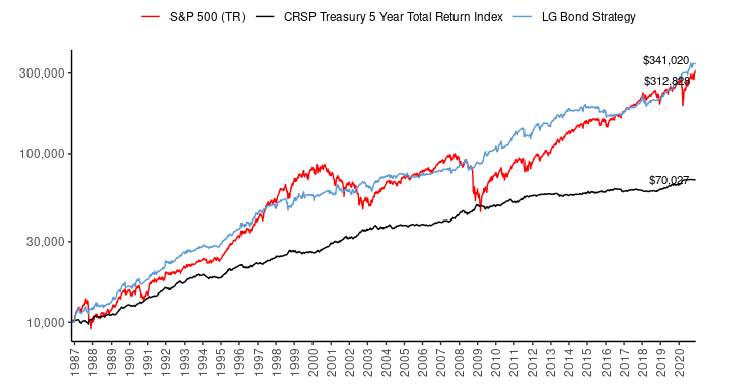

Let’s look at the results up until 2020 (taken from Gayed’s paper):

Lumber/Gold ratio trading strategy for stocks and bonds – trading rules

We changed Gayed’s trading rules, and we did the following:

Trading Rules

- Make a lumber/gold ratio;

- When the ratio is higher than the month before, we go long S&P 500 (SPY);

- When the ratio is lower than the month earlier, we go long bonds (TLT).

As a proxy for lumber, we use the ETF with the ticker code WOOD. That ticker is not very liquid. For gold, we use the ETF with the ticker code GLD.

Our trading rules deviate a little from Gayed’s, but let’s backtest our rules and setup:

Lumber/Gold ratio trading strategy for stocks and bonds – backtest

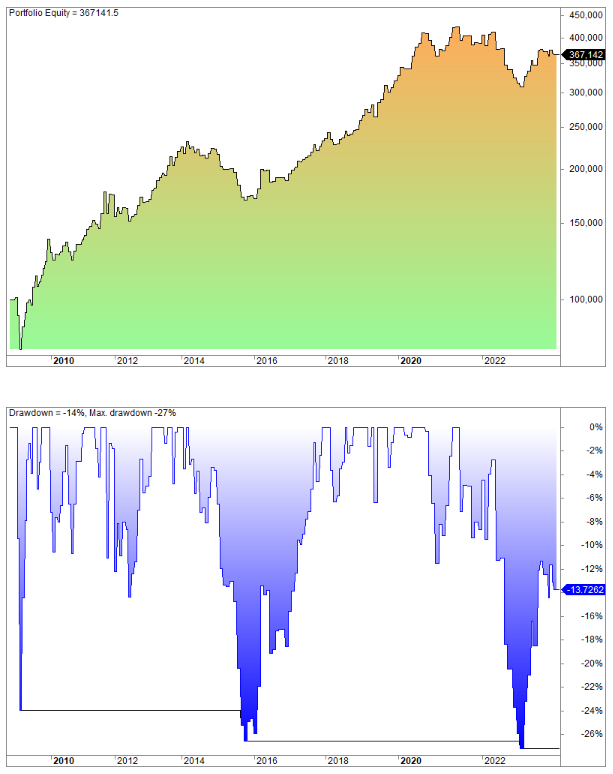

When we coded the trading rules in Amibroker, we got the following equity curve:

The results are good, but the bond market collapse in 2022/23 made the earlier drawdowns small: 35% drawdown!

Still, the annual returns since 2008 are 11.4%, and the average gain per trade is 2.2%.

Does switching TLT with gold perform better, meaning we rotate between SPY and GLD (instead of SPY and TLT)?

This is the equity curve and drawdowns:

The performance is significantly worse than for SPY/TLT: 8.7% annual returns.

Lumber/Gold ratio trading strategy for stocks and bonds – conclusion

Despite the setback for bonds (and stocks) in 2022, the average gains are high. However, we suspect most would abandon the strategy with a 35% drawdown. Keeping faith in a rotation trading strategy with such a drawdown is hard. Most traders and investors fold.