100+ Data Driven Trading Strategies

Data-driven trading strategies harness numbers to predict market trends with precision. This article unpacks these strategies, showing you how to analyze and use data to make informed decisions that could help to maximize profits and minimize risks. Explore how to sift through the noise of the market and pinpoint the data that matters most to your trading success.

Key Takeaways

- Data-driven trading strategies revolutionize trading by using historical and market data analysis to identify trading opportunities and trends, enhance risk management, and inform pricing strategies.

- Quantitative and algorithmic trading strategies employ mathematical models and automated systems, respectively, to sift market noise, predict trends, manage risk, and execute trades with precision and speed while minimizing human errors.

- 100+ Data Driven Trading Strategies: 100+ Data Driven Trading Strategies (Backtested)

- Machine learning and the use of alternative data from sources like social media are the forefront of data-driven trading, offering advanced analytics for enhancing trading decisions, overcoming market noise, and providing real-time data for agile decision-making.

Harnessing the Power of Data Analysis in Trading

The advent of data-driven investing has revolutionized the trading landscape, empowering individuals and institutions alike to make precision-guided trading decisions. By diving into the depths of historical and market data, traders extract a wealth of insights, enabling them to identify market trends and seize trading opportunities. In the realm of financial markets, where every second and every penny counts, the strategic use of data analysis has become a pivotal element in crafting winning trading strategies.

Whether you’re a retail trader or a seasoned quant, leveraging data science services has proven to be a catalyst for innovation in risk management and pricing strategies.

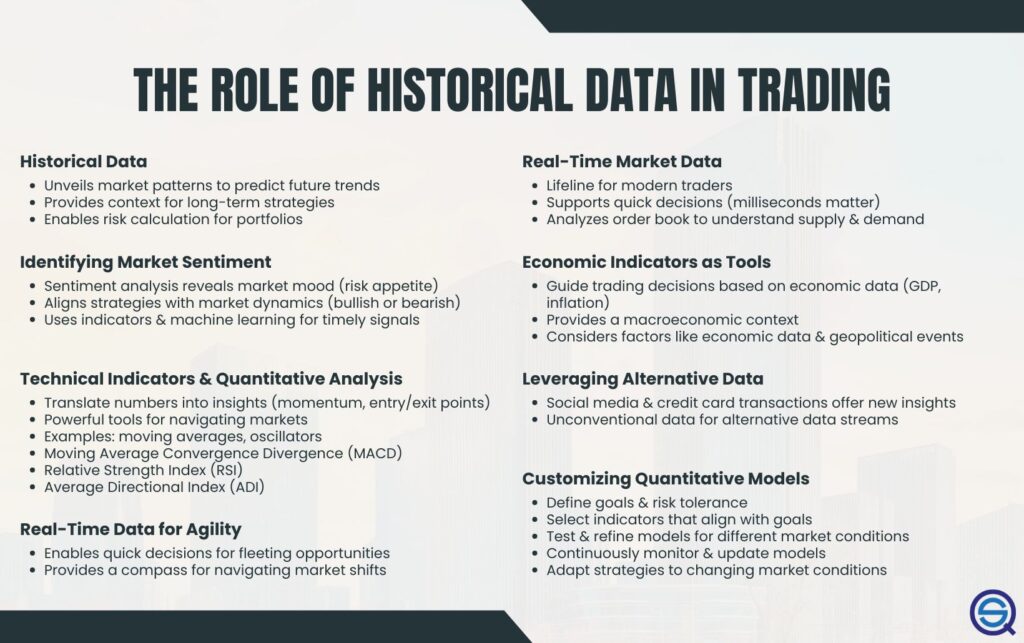

The Role of Historical Data

Sifting through historical price data is akin to an archaeologist unearthing relics of the past to predict the future. Historical data is the bedrock upon which traders forecast future price movements. It provides the essential context that informs long-term strategies, enabling investors to project pricing trends and calculate market risk on portfolios of investments.

In this way, past data serves as the compass that guides traders through the tumultuous seas of market speculation.

Market Data Insights

Real-time market data is the lifeblood of the modern trader, supporting swift decision-making in an environment where milliseconds can mean the difference between profit and loss. By continually updating and optimizing quantitative models with the latest data, traders stay ahead, adapting to the ever-changing market conditions with agility.

In the age of machine learning, real-time order book analysis is not just a tool; it’s a necessity for understanding the intricacies of supply and demand dynamics, providing invaluable insights that can transform a speculative gamble into an informed investment decision.

Crafting Effective Data Driven Trading Strategies

In the fabric of the financial markets, each thread—each data point—can reveal patterns and inform decisions when woven together through effective data-driven trading strategies. The interplay of computer modeling, predictive analysis, and algorithmic trading forms a tapestry of techniques that enhances performance and manages risk. These strategies, rooted in data analysis and executed by algorithms, respond to market conditions with a precision that human traders could scarcely hope to match. Yet, crafting these strategies is not without its challenges; traders must navigate the complexities of noisy data and the perils of overfitting to past market behaviors to achieve success.

Integrating Quantitative Trading Strategies

The cornerstone of quantitative trading strategies lies in the intricate mathematical models and statistical prowess that sift through market noise to identify golden trading opportunities. These strategies, ranging from market making to arbitrage, are built upon a foundation of mathematical finance formulas and specialized software. By analyzing trading volumes and asset prices, quantitative traders can predict trends and adapt their methods to various asset classes and industries, harnessing the power of both fundamental and technical analysis variables.

The precision of a well-oiled quantitative strategy, such as arbitrage, exemplifies the finesse of executing trades in fractions of a second to capture pricing discrepancies across markets for profit.

Algorithmic Trading Systems

Algorithmic trading systems, also known as automated trading, are the silent sentinels of the trading world, executing trades automatically, adhering to predefined rules, and minimizing human errors and emotional bias. In the high-stakes arena of financial markets, these systems offer a bulwark of consistency and discipline, ensuring that trading activities are executed with rapid precision and based on logical, data-driven investment decisions.

As financial institutions, including banks and hedge funds, increasingly rely on these systems, the demand for low latency and integrated market data management has soared, highlighting the growing complexity and globalization of capital markets.

Risk Management through Data-Driven Methods

The art of risk management in trading is a delicate dance, balancing the pursuit of profit with the protection against potential losses. Data-driven methods such as position sizing and stop-loss orders provide the structure for this dance, allowing traders to maneuver with confidence as they navigate the unpredictable rhythms of the market.

Yet, the chorus of quantitative indicators must be choreographed with care, ensuring that the risks of unexpected market events are considered and systems are rigorously tested to withstand the test of time and volatility.

Identifying Market Sentiment

Tapping into the collective psyche of the market, sentiment analysis reveals the prevailing mood of traders, offering a glimpse into the undercurrents of risk appetite. By aligning with this sentiment—be it the bullish charge of risk-on or the cautious retreat to safe-haven assets during risk-off phases—traders can steer their strategies in harmony with market dynamics.

Sentiment indicators and machine learning tools parse through the cacophony of market voices to deliver signals that are both timely and telling, allowing traders to navigate the ebb and flow of market sentiment with finesse.

Economic Indicators as Predictive Tools

Economic indicators are the beacons by which traders chart their course, illuminating the potential impact of GDP growth, inflation rates, and employment figures on market sentiment and trading decisions. These indicators provide a macroeconomic context, enabling traders to discern the shifting tides of market conditions and align their trading strategies with informed foresight.

The tapestry of market sentiment is woven from various threads, including economic data, geopolitical events, and market expectations, each influencing the overall picture of risk and opportunity.

Technical Indicators and Quantitative Analysis

Technical indicators, the alchemists of the trading world, transmute numerical values into insights that reveal market momentum and potential entry or exit points. When combined with the precision of quantitative analysis, these indicators become powerful tools that help traders chart a path through the financial markets.

From moving averages that smooth out volatility to oscillators that gauge the pulse of market sentiment, technical indicators serve as the compass for navigating the terrain of market trends.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) stands as a stalwart indicator, charting the momentum of the market with an eye for impending reversals. By tracking the interplay between exponential moving averages, the MACD flags potential shifts in market direction, alerting traders to the whispers of change before they become roars.

The MACD histogram, in particular, acts as a barometer for momentum change, offering a visual cue that complements the trader’s arsenal of analytical tools.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) serves as a sentinel, warning of overbought and oversold conditions that portend potential market shifts. By measuring the velocity and magnitude of price movements, the RSI provides a gauge for market sentiment, offering traders a vantage point from which to anticipate and act upon price corrections.

In the constant tug-of-war between buyers and sellers, the RSI is a trusted negotiator, advising when to hold firm and when to capitulate.

Average Directional Index (ADI)

The Average Directional Index (ADI) is a compass for traders, pointing to the strength of a trend and guiding them through the landscape of market sentiment. With its values reflecting the vigor of market movements, the ADI empowers traders to make informed decisions about the potential for trend continuations or reversals, anchoring their strategies in the bedrock of data-driven insight.

Balancing Your Strategy: The Perils of Too Many Indicators

Navigating the dense forest of technical indicators requires a strategy that is both nimble and discerning. An overabundance of indicators can lead to conflicting signals, causing traders to hesitate at crucial moments.

To avoid the paralysis of analysis, traders must focus on a select suite of indicators that resonate with their trading style and objectives, ensuring a clear path is charted through the thicket of potential trends and signals. Implementing a well-defined trading strategy can help in achieving this goal.

Choosing Indicators Aligned with Investment Objectives

Selecting the right indicators is a personal journey, one that aligns with the trader’s unique investment objectives and risk tolerance. Whether seeking the thrill of quick trades or the stability of long-term movements, the choice of indicators must reflect these preferences.

Momentum indicators may suit the swift trader, while value investors might lean on the solid ground of fundamental indicators to guide their decisions.

The Importance of Overlay Indicators

Overlay indicators are the cartographers of the trading world, providing a clear map of price trends directly on the price charts. Unlike oscillators, which signal the market’s overbought or oversold states, overlay indicators like moving averages and Bollinger Bands smooth out price action, offering a more holistic view of market trends.

Their simplicity allows for a clean visual analysis, enabling traders to focus on the essence of market movements without the distraction of excessive complexity.

Machine Learning: The Future of Data Driven Trading

Machine learning and AI represent the cutting edge of trading, transforming vast and complex financial datasets into a crystal ball of market trends. These advanced algorithms not only enhance trading decisions but also redefine the landscape of investment strategy.

As retail traders harness the power of big data and AI, they unlock the potential to generate Alpha and secure competitive advantages in a market that is ever-evolving.

Enhancing Trading Decisions with Machine Learning

Machine learning algorithms are the treasure hunters of the data realm, uncovering hidden trends and enhancing trading decisions. As market volatility climbs, the reliance on quantitative analysis and trading indicators becomes more pronounced, with machine learning serving as the key to deciphering real-time data and making agile, informed trading decisions.

Overcoming Market Noise with Advanced Analytics

Advanced analytics act as a filter, sifting through the cacophony of market noise to distill pure, actionable insights. In a domain where certainty is elusive, machine learning models offer a beacon of prediction, guiding traders through the murky waters of financial markets with an informed compass.

Leveraging Alternative Data in Trading Strategies

In the quest for an edge in trading, alternative data emerges as an invaluable ally, offering insights that lie beyond the reach of conventional market data. From the digital footprints of social media to the transaction trails of credit cards, this unconventional data provides a unique vantage point from which traders can discern new investing opportunities and insights.

The Impact of Social Media on Market Dynamics

Social media, the public square of the digital age, plays an increasingly pivotal role in shaping market dynamics. Deep learning and other machine learning models analyze the vast and varied narratives told across social platforms, extracting signals that can forecast stock market movements with remarkable accuracy.

These alternative streams of volume data, pulsing with the opinions and sentiments of the crowd, can presage consumer behavior and, by extension, the financial performance of companies.

Real-Time Data for Agile Decision Making

Real-time data is the currency of agility in today’s trading landscape. It enables traders to make swift, tactical decisions, capitalizing on fleeting market opportunities that could vanish in the blink of an eye.

In an environment where change is the only constant, real-time data provides a compass for navigating shifting market conditions and managing risk with immediacy and precision.

Customizing Quantitative Models for Your Trading Goals

The tailoring of quantitative models is a bespoke process, requiring a clear definition of trading objectives, preferences, and constraints to ensure that strategies align with expected return, risk tolerance, and market conditions. By starting with a clear set of goals and judiciously selecting indicators that resonate with those aims, traders can customize their quantitative models to serve as a personalized roadmap to financial success. Some key steps in this process include:

- Clearly define your trading objectives, preferences, and constraints.

- Select indicators that align with your goals and objectives.

- Test and refine your model to ensure it performs well under different market conditions.

- Continuously monitor and update your model as market conditions change. By following these steps, traders can create customized quantitative models that are tailored to their specific needs and increase their chances of achieving financial success.

Adapting to Changing Market Conditions

The markets are living entities, constantly evolving and presenting new challenges. Adapting to these changes requires a dynamic approach to strategy development, one that can pivot as swiftly as market conditions themselves. By modifying strategy parameters and incorporating sensitivity analysis, traders ensure that their quantitative models stay in tune with the market’s rhythm, moving in step with its fluctuations and shifts.

Backtesting for Confidence

Backtesting is the crucible in which trading strategies are tested and refined. By simulating a strategy’s performance using historical market data, traders can gain the confidence that their approach is sound before they deploy it in the unpredictable theatre of live trading. This process not only helps in deciding on specific parameters but also safeguards against biases that can distort a strategy’s true potential, ensuring that it is robust and ready for the rigors of the real market.

Summary

As we draw the curtains on our exploration of data-driven trading strategies, we see that the power of data analysis in trading is undeniable. From the bedrock of historical data to the cutting edge of machine learning, traders now have access to a plethora of tools and techniques to inform their decisions. By embracing these methods, engaging with real-time and alternative data, and customizing strategies to align with personal trading goals, traders can navigate the financial markets with greater confidence and agility. Let this be your guide to a more informed, data-driven trading future.

Frequently Asked Questions

What are the advantages of using historical data in trading strategies?

Using historical data in trading strategies helps identify patterns and trends, enabling informed investment decisions and providing valuable context for long-term strategies.

How do real-time market data affect trading decisions?

Real-time market data is crucial for making quick and informed trading decisions, enabling traders to react swiftly to changing market conditions and seize immediate opportunities.

What is the role of machine learning in data-driven trading?

Machine learning plays a crucial role in data-driven trading by analyzing financial data to uncover trends, improve trading decisions, and generate predictive signals that can result in profitable investments, even in volatile markets.

How can traders avoid the perils of using too many trading indicators?

To avoid the perils of using too many trading indicators, traders should focus on a concise set of tailored indicators aligned with their investment goals and risk tolerance, while ensuring a clear trading plan. This will help in avoiding analysis paralysis and conflicting signals.

What is the importance of backtesting in trading?

Backtesting is crucial in trading as it allows traders to confirm the effectiveness of their strategies with historical data, gaining confidence and refining their approaches to minimize risk.