One Day Loss Trading Strategy (1.73% Overnight Returns)

Have you ever wondered if it’s possible to profit from stocks that experience significant one-day drops?

New research sheds light on economically significant short-term price reversals, offering insights for traders looking to refine their strategies and potentially achieve substantial returns:

Consistent with the overreaction hypothesis, trading strategy returns increase in the magnitude of event day loss. Consistent with behavioral models, the reversals are higher for event stocks without concurrent news releases. The evidence is generally supportive of the liquidity pressure hypothesis. The analysis suggests refined trading strategies yielding economically significant positive returns. The results are robust to a number of alternative tests.

This article delves into a study that rigorously examines the profitability of contrarian trading rules, directly accounting for transaction costs, and exploring the factors that drive these reversals.

Although the study is a bit old (2003), it may still be profitable. We emphasize that we at QuantifiedStrategies.com have NOT backtested or verified the results.

One Day Loss Trading Strategy: Refutes Market Efficiency

The concept of price reversals in stock markets has been a subject of extensive research for decades. While many prior studies acknowledged statistically significant reversals, they often concluded that these did not translate into economically significant profits once transaction costs were considered.

This new analysis distinguishes itself by directly incorporating intraday bid and ask quotes into its return calculations, providing a more precise measure of real-world profitability. By doing so, it provides compelling evidence that economically significant short-term price reversals do exist.

The study focuses on stocks experiencing large one-day losses (exceeding 10% close-to-close) during 2000-2001. The trading strategy involves buying these “loser” stocks at the average ask price during the last 15 minutes of the event day and selling them at bid prices at various points on the next trading day.

Key Drivers of Stock Price Reversals: Overreaction, News, and Liquidity

The research explores several theoretical explanations for these price reversals:

• Investor Overreaction Hypothesis:

◦ This theory suggests that investors often overreact to new information, leading to an initial mispricing that is later corrected.

◦ Consistent with this, the study finds that trading strategy returns increase with the absolute magnitude of the event day loss. The greater the initial loss, the larger the subsequent reversal and potential profit.

• The Role of Public Information (News Releases):

◦ While overreaction is often linked to news, the study explicitly examines the impact of public information flow.

◦ A critical finding is that reversals are significantly higher for event stocks that occur without concurrent public news releases. This supports behavioral models suggesting that investors overreact to extreme price moves that are not accompanied by public information.

◦ Conversely, price changes for firms with news releases might represent a more permanent revaluation, leading to less pronounced reversals.

• Temporary Liquidity Pressure:

◦ Reversals can also stem from a temporary lack of liquidity in the markets, where intense selling pressure pushes prices down further than warranted.

◦ The evidence generally supports this hypothesis: returns are found to increase with event day trading volume. High trading volume on the event day suggests significant selling pressure, which is subsequently corrected.

◦ Interestingly, the study also notes a puzzling positive relationship between reversals and company capitalization (firm size), which runs contrary to some liquidity pressure predictions and warrants further research.

One Day Loss Trading Strategies

The conclusions from the cross-sectional analysis led to the identification of refined trading strategies with economically significant positive returns. By focusing on specific characteristics of event firms, traders can enhance their profitability:

- Focus on Large Capitalization Stocks: Strategies targeting stocks in the top quartile of capitalization yield substantially higher average returns.

- Prioritize High Trading Volume: Similarly, stocks with event day trading volume in the top quartile show superior performance.

- Identify Extreme Losses: The most profitable strategies are observed for stocks with relative event day losses exceeding 30% or 35%.

- Combining these refinements proves highly effective. For instance, a strategy focusing solely on stocks with:

- Event day trading volume in the top quartile.

- Relative event day losses exceeding 30%.

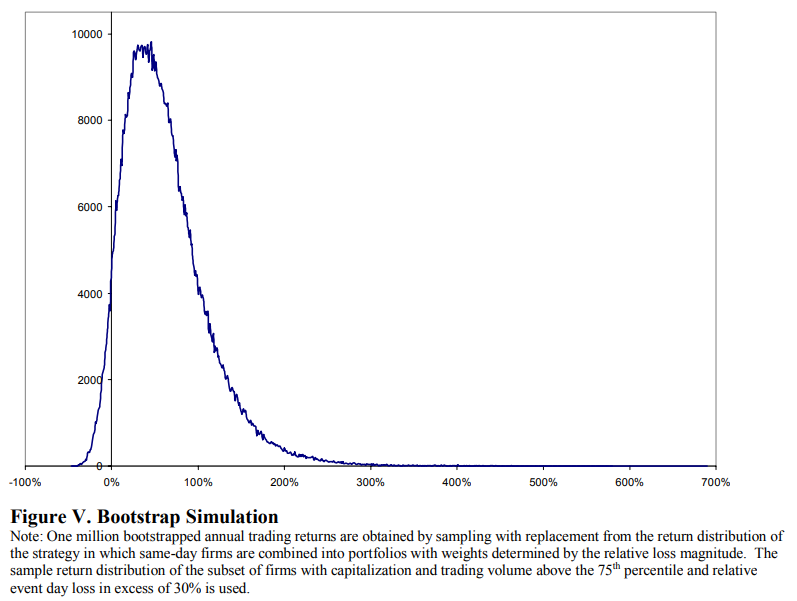

This specific strategy yielded average overnight returns of 1.10%. For losses exceeding 35%, this strategy can result in 1.73% overnight returns. Such consistent returns, if reinvested, could lead to impressive annual returns; one simulation showed an annual return of 54.29%, with bootstrapped simulations averaging 61.13%.

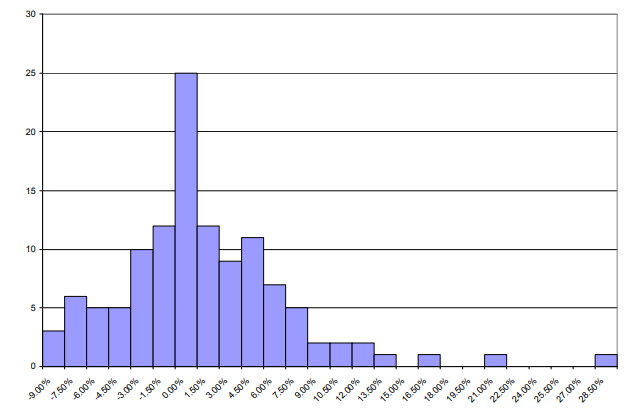

The chart below displays the distribution of trading returns for firms whose market capitalization and trading volume are above the 75th percentile, and that experienced a relative event-day loss greater than 30%, with each event firm analyzed individually:

One Day Loss Trading Strategy – Conclusion

Unlike prior research that found reversals to be too small to overcome transaction costs, this study demonstrates that by carefully incorporating intraday bid-ask spreads and identifying specific subsets of “loser” stocks, traders can achieve tangible profits.

The methodology highlights the importance of precise transaction cost measurement and underscores how investor overreaction, information flow (or lack thereof), and liquidity dynamics create opportunities for contrarian strategies.

This research offers practical guidance for developing robust short-term trading strategies, suggesting that market participants can indeed identify and capitalize on profitable opportunities arising from stock price overreactions following large one-day declines.