Overnight Crypto Returns – It Works! (Statistics And Facts)

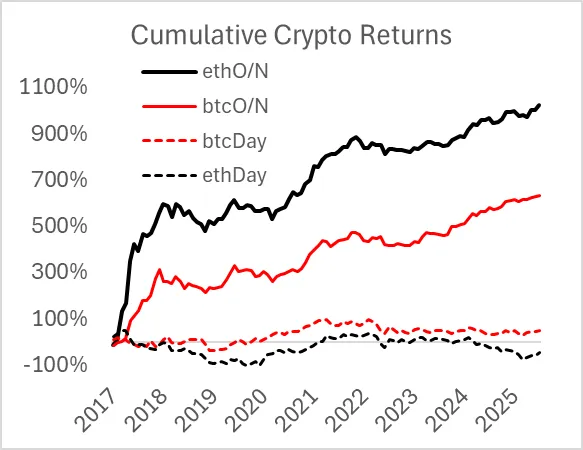

While traditional equity markets have shown diminishing overnight return anomalies since 2008, cryptocurrency markets tell a dramatically different story. Recent analysis reveals that virtually all Bitcoin (BTC) and Ethereum (ETH) returns occur during overnight hours when US equity markets are closed, creating a potentially exploitable trading pattern.

This article is a summary of the findings in Falkenblog’s article called Overnight Crypto Returns.

Key Takeaways

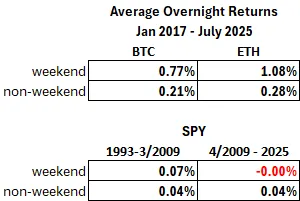

- Crypto overnight returns dominate total returns: Bitcoin and Ethereum generate +48 vs -2 basis points during overnight vs intraday periods

- Weekend effect amplifies the anomaly: Overnight returns are 3-4 times higher over weekends compared to weekdays

- US market influence: Despite crypto’s global nature, US trading hours appear to drive the pattern

- Subsample stability: The anomaly persists across different market conditions, though 2017 dominates overall returns

- Risk considerations: The pattern works in both bull and bear markets, with overnight periods capturing most volatility

Understanding the Overnight Crypto Return Anomaly

What Are Overnight Returns?

Overnight returns in cryptocurrency refer to price movements that occur when US equity markets are closed (4:00 PM to 9:30 AM EST). Unlike traditional markets that close, crypto markets operate 24/7, making this analysis particularly interesting.

The data reveals striking differences:

- Bitcoin overnight returns: +48 basis points average

- Bitcoin intraday returns: -2 basis points average

- Ethereum overnight returns: +48 basis points average

- Ethereum intraday returns: -2 basis points average

For comparison, equity overnight returns during the same period averaged only +4 basis points versus +2 basis points intraday.

Historical Performance Analysis

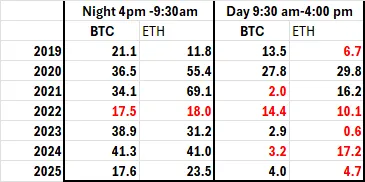

The subsample stability test reveals important insights about this anomaly’s persistence. While 2017’s crypto boom dominates the overall statistics, the overnight advantage continues throughout different market cycles:

- Bull markets (2020): Gains shared between day and night

- Bear markets (2022): Losses shared between day and night

- Recent period (2022-2025): Night returns clearly dominate

The Weekend Effect in Crypto

One of the most striking aspects of the crypto overnight anomaly is its amplification during weekends – the weekend effect. Weekend overnight returns generate 3-4 times the returns of weekday overnight periods.

This pattern differs significantly from the historical equity overnight effect, which was also weekend-dominated but to a lesser degree. When the equity overnight effect diminished post-2009, much of the decline was attributed to the disappearance of weekend premiums.

Daily Patterns Within the Week

The analysis reveals complex intraweek patterns:

- Wednesday and Thursday nights: Significantly smaller overnight returns

- Tuesday and Thursday: Lower intraday returns drive overall weekly averages

- Weekend periods: Consistently strong overnight performance

Why Does This Anomaly Exist?

US Market Dominance Theory

Despite cryptocurrency’s global nature, several factors suggest US market influence:

- Trading volume patterns: Most crypto trading occurs during US market hours

- Correlation with equities: Crypto and equity markets show increasing correlation

- Institutional adoption: Growing US institutional participation in crypto markets

The data from Uniswap (a major decentralized exchange) shows trading activity peaks during NYSE operating hours, supporting the theory that US markets drive crypto price discovery.

Market Microstructure Considerations

Unlike the failed equity overnight ETFs that suffered from:

- High transaction costs from twice-daily portfolio turnover

- Diminishing anomaly strength post-2008

- Timing and execution challenges

Crypto markets offer potential advantages:

- Lower transaction costs on major exchanges

- 24/7 trading eliminates timing issues

- Stronger and more persistent anomaly

Practical Implementation Considerations

Transaction Costs and Execution

Key factors for potential implementation:

- Exchange selection: Major exchanges like Binance offer competitive fees

- Execution timing: 24/7 markets eliminate the timing issues that plagued equity strategies

- Position sizing: Crypto volatility requires careful risk management

- Tax implications: Frequent trading may have tax consequences

Future Outlook and Sustainability

Potential Risks to the Anomaly

Several factors could threaten the sustainability of crypto overnight returns:

- Increased arbitrage: As awareness grows, arbitrageurs may eliminate the anomaly

- Market maturation: Crypto markets may become more efficient over time

- Regulatory changes: New regulations could alter trading patterns

- Institutional adoption: Greater institutional presence might reduce anomalies

Market Evolution Considerations

The crypto market’s rapid evolution means patterns observed today may not persist:

- Liquidity improvements: Better liquidity could reduce overnight premiums

- Global adoption: Increased global trading might diminish US influence

- Technology changes: New trading technologies could alter market microstructure

Conclusion: A Viable but Risky Opportunity

The overnight crypto return anomaly presents a compelling trading opportunity that appears more robust than its failed equity counterpart. With average overnight returns of +48 basis points versus -2 basis points intraday for both Bitcoin and Ethereum, the effect is both economically and statistically significant.

Key Success Factors:

- Lower transaction costs compared to equity strategies

- 24/7 market access eliminates timing issues

- Strong weekend effect amplifies returns

- Persistent across different market cycles

Critical Risks:

- High volatility requires careful position sizing

- Anomaly could disappear as markets mature

- Regulatory risks in evolving crypto landscape

- Past performance doesn’t guarantee future results

For traders considering this approach, remember that while the historical data is compelling, cryptocurrency markets are inherently volatile and unpredictable. Any strategy should be thoroughly backtested, properly risk-managed, and represent only a portion of a diversified trading portfolio.

The overnight crypto anomaly may represent a genuine market inefficiency, but like all trading strategies, it requires careful implementation and constant monitoring for signs of decay. As Eric Falkenstein noted in his original analysis, this pattern was discovered recently and deserves further investigation before drawing definitive conclusions about its long-term viability.