Why Every Trader Should Diversify Into Gold Strategies

When traders think about diversification, they often focus on spreading risk across different stocks, sectors, or asset classes. But few consider the powerful benefits of adding gold strategies to their trading portfolio.

Gold has historically behaved differently from equities, bonds, and other commodities, often showing unique return patterns during times of market stress or inflation.

By diversifying into gold trading strategies, traders can smooth out performance, reduce drawdowns, and improve long-term risk-adjusted returns. In this article, we’ll explore why gold deserves a place in your systematic trading approach and how it can strengthen your overall portfolio.

This article is based on research by the hedge fund DE Shaw in an article called Worth Its Weight? Assessing Gold’s Portfolio Utility.

Related reading: –Top Gold Trading Strategies 2025: 10 Different Types

What is gold?

Gold is the prototypical non-productive store of value (NPSOV). As the name suggests, NPSOVs do not generate cashflow. They are scarce assets that society has deemed valuable and secure over time, sought primarily for their ability to retain value.

Gold presents unique challenges for modeling because it does not generate income, its return drivers are variable, and its long-term upside potential is unclear.

In fact, gold’s lack of cashflows might suggest a long-term real return of zero, or even less after accounting for storage costs. Put another way, gold is expected to preserve its value after inflation, but not necessarily increase it.

However, the sources note that gold’s lack of productive capacity can be seen as a feature, not a drawback.

The Power of Low Correlation with Equities

The primary benefit of gold to a diversified portfolio stems directly from this non-productive nature: its correlation, or lack thereof, with pro-cyclical assets like stocks.

While the relationship between gold and economic growth is complex, it is positively correlated with global wealth but often considered a safe haven during elevated market volatility, these forces tend to offset one another. As a result, the analysis finds that gold is less exposed to the traditional business cycle.

Empirical evidence supports this diversifying property:

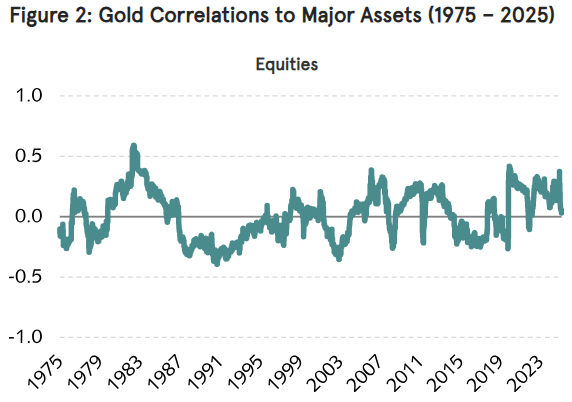

- The rolling correlation between gold and U.S. equities has been quite volatile over the past five decades, averaging 0.01.

- The correlation has changed sign numerous times.

- The analysis uses the assumption of no correlation between gold and stocks for modeling purposes.

This low correlation matters greatly. Gold’s lack of significant exposure to equity risk offers potential utility to a portfolio otherwise dominated by stocks and bonds. This is true even though gold’s expected risk-adjusted return may not compare favorably with traditional assets.

Gold’s Utility in Portfolio Optimization

An optimization framework helps analysts better understand how correlation and tail risk affect portfolio outcomes. Even with a modest expected excess return assumption (such as 0.5% in excess of a real risk-free rate) and a volatility estimate of 15%, an optimizer finds notable value in a lowly-correlated asset like gold.

Gold’s diversification benefits become even more pronounced in specific market environments:

1. Positive Stock-Bond Correlation

The relationship between stocks and bonds is one of the most important relationships for investors. The stock-bond correlation became positive for a time starting in 2021, after remaining negative for over two decades. When bonds are highly correlated to stocks, the marginal portfolio utility of any asset that is uncorrelated to stocks goes up. Therefore, the potential portfolio utility of gold increases in a positive stock-bond correlation environment.

2. Tail Risk and Crash Scenarios

Gold is widely considered a safe haven during periods of instability.

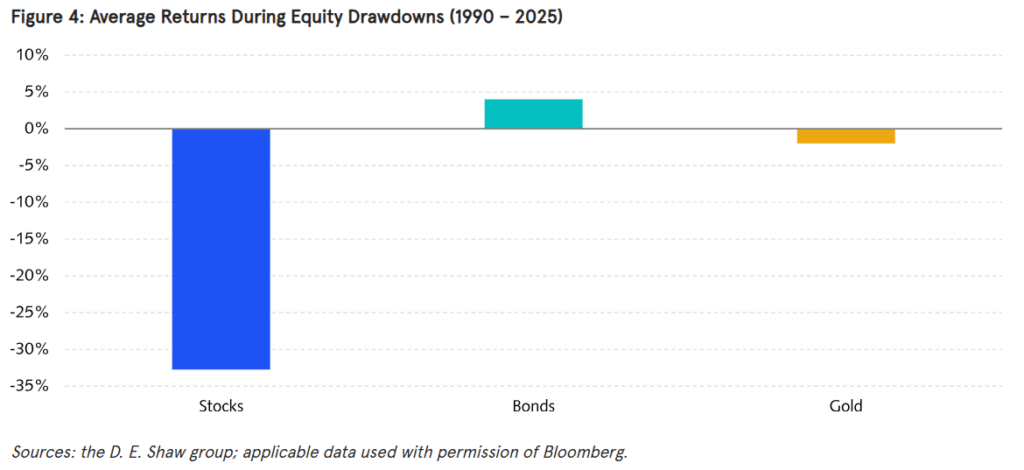

- Equity Drawdowns: When equities have dropped 25% or more in less than three months (between 1990 and 2025), gold’s average return was -2%, which is notably better than the average return for equities (-33%), though worse than bonds (4%).

- Inflationary Shocks: Gold can provide a tailwind for real assets during inflationary shocks caused by factors like excess demand, supply chain issues, or tariffs, which are generally painful for both stocks and bonds.

The optimizer finds additional utility in gold when accounting for crash events. Gold’s tendency to “crash differently” makes it more attractive, meaning that potential events leading to a drop in gold’s value (like being replaced by an alternative NPSOV or a material increase in supply growth) are unlikely to coincide with a crash in a portfolio’s other assets.

In summary, working with an optimizer reminds us that gold’s relative lack of productive applications is a primary benefit, offering potential portfolio utility because it is broadly uncorrelated to pro-cyclical assets while still growing along with global wealth.