Gator Oscillator – Rules, Strategy, Backtest

There are different types of tools and indicators professional traders can use to track markets and price action, but oscillators seem to suit swing traders more, which is why the Gator Oscillator was created from the already existing Alligator indicator. What do you know about this oscillator?

Derived from the Alligator indicator, the Gator Oscillator offers a different view of the behavior of the Alligator indicator. As with most oscillators, the Gator Oscillator is plotted in an indicator window below the price chart. It consists of a dual histogram simultaneously plotted above and below the 0.0 centerline, with the bars above representing the absolute distance between the Alligator’s jaws (13-period SMMA) and teeth (8-period SMMA) and the bars below representing the absolute distance between teeth and lips (5-period SMMA).

In this post, we will take a look at most of the questions you may have about the Gator Oscillator: what it is, how it works, and how you can use it to improve your trading strategies. Read on!

Key takeaways

- The Gator Oscillator is derived from the Alligator Indicator (itself created by Bill M. Williams).

- It is plotted as a dual-histogram (bars above and below a zero line). The bars above represent the absolute distance between the 13-period SMMA (Jaws) and the 8-period SMMA (Teeth); the bars below represent the absolute distance between the 8-period and 5-period SMMA (Teeth and Lips).

- Bars are colour-coded: green when a bar is larger than the previous bar (i.e., the gap is expanding), red when the bar is smaller (gap narrowing).

- When the moving averages are tightly tangled (gaps small, histogram bars near zero, often red), the Alligator is said to be “sleeping”. The market is likely consolidating. Q

- When the histogram bars begin expanding (green bars increasing), it indicates the moving averages are fanning out, implying the Alligator is “opening its mouth” and a trend may be starting.

- When the histogram bars start contracting again (red bars moving toward zero), it suggests the trend may be ending and the market is going back into consolidation.

- The article provides a back-test on the S&P 500 cash index (weekly bars) showing 15 trades, an average gain of 43.1%, a win rate of 93%, max drawdown of 33% and annualized return of ~7.2% (versus buy-and-hold about 7.5%).

- Please click here for all top technical trading indicators.

What is the Gator Oscillator?

Derived from the Alligator indicator, the Gator Oscillator offers a different view of the behavior of the Alligator indicator. As with most oscillators, the Gator Oscillator is plotted in an indicator window below the price chart. It consists of a dual histogram with bars simultaneously plotted above and below the 0.0 centerline.

The bars above the centerline represent the absolute distance between the Alligator’s jaws (13-period SMMA) and teeth (8-period SMMA), while the bars below the centerline represent the absolute distance between teeth and lips (5-period SMMA).

The histogram bars are color-coded — painted green or red color. A green means that the bar is bigger than the previous one, and a red bar means that the bar is smaller than the preceding one. Given what the bars represent, consecutive (expanding) green bars indicate that the moving averages are spreading out – the Alligator is opening its mouth to eat.

On the other hand, contracting red bars indicate that the moving averages are converging, and getting close to the 0.0 line indicates that the market is probably consolidating – the Alligator’s mouth is closed as it goes to sleep.

The Gator Oscillator provides a living perspective to the Alligator’s behavior. Traders often combine both indicators to get a better interpretation of the market behavior, as the Gator Oscillator makes it recognize and appreciate the information shown by the Alligator Indicator.

How does the Gator Oscillator work?

To understand how the Gator Oscillator works, you have to refresh your mind on the Alligator indicator. The Alligator indicator consists of 3 smoothed moving averages (SMMAs), which are offset towards the future:

- A 13-period SMMA moved 8 bars into the future, which is referred to as the Alligator’s Jaws (the blue line)

- An 8-period SMMA moved 5 bars into the future, which is referred to as the Alligator’s Teeth (the red line)

- A 5-period SMMA moved 3 bars into the future, which is referred to as the Alligator’s Lips (the green line)

When the moving average lines are twisted on each other, the Alligator is sleeping. When they fan out, the Alligator is awake and ready to eat profits in the market.

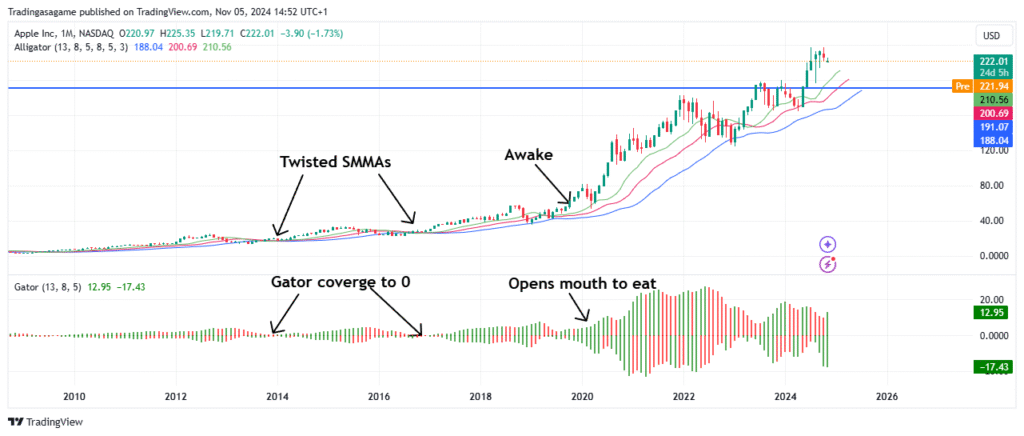

To get a better visual representation of this indicator’s behavior, the author created the Gator Oscillator to present the distances between the moving averages in a histogram, as you can see in the indicator window of the next chart below:

As you can see, the Gator Oscillator simultaneously plots histogram bars above and below the 0.0 centerline. The bars above the centerline represent the absolute distance between the Alligator’s jaws (13-period SMMA) and teeth (8-period SMMA), while the bars below the centerline represent the absolute distance between teeth and lips (5-period SMMA).

A green means that the bar is bigger than the previous one, suggesting that the space between the moving averages is increasing. A red bar means that the bar is smaller than the preceding one, implying a narrowing of the space between the moving averages.

Thus, expanding green bars indicate that the moving averages are fanning out, which represents the Alligator opening its mouth to eat. On the other hand, contracting red bars indicate that the moving averages are converging. When it gets close to the 0.0 line, it means that the moving averages are now crisscrossing each other. This indicates that the market is probably consolidating – the Alligator’s mouth is closed as it goes to sleep.

Gator Oscillator trading strategy- rules, settings, returns, and performance

We made a backtest of the Gator Oscillator. We backtested the cash index of the S&P 500 from 1960 until today using weekly bars:

The strategy has only 15 trades, with an average gain of 43.1%. The win rate is 93%, and the max drawdown is 33. The strategy is invested 77% of the time but still manages an annual return of 7.2%—just a tad below buy-and-hold’s 7.5%.

Gator Oscillator trading strategy – complete code

The Amibroker code for the backtest looks like this:

THIS SECTION IS FOR MEMBERS ONLY. _________________ BECOME A MEBER TO GET ACCESS TO TRADING RULES IN ALL ARTICLES CLICK HERE TO SEE ALL 400 ARTICLES WITH BACKTESTS & TRADING RULES

CLICK HERE TO SEE ALL 400 ARTICLES WITH BACKTESTS & TRADING RULES

Who developed the Gator Oscillator?

The Gator Oscillator was developed by Bill M. Williams, a renowned American trader and technical analyst. He is the author of many books on different aspects of trading, including trading psychology, technical analysis, and chaos theory.

An expert on stock, commodity, and foreign exchange (Forex) markets, he is known for creating several technical indicators, including the Alligator Indicator, Accelerator/Decelerator Oscillator, Awesome Oscillator, Market Facilitation Index, and Fractals indicator.

What are the components of the Gator Oscillator?

The components of the Gator Oscillator are as follows:

- Positive histogram bars: These are bars above the centerline. They represent the absolute gap between the Alligator’s Jaws (13-period SMMA) and teeth (8-period SMMA). When the gap is expanding, the bars are colored green and get bigger. When the gap is narrowing, the bars are colored red and get smaller.

- Negative histogram bars: These are bars above the centerline. They represent the absolute distance between the Alligator’s Teeth (8-period SMMA) and Lips (5-period SMMA). When the gap is expanding, the bars are colored green and get bigger. When the gap is narrowing, the bars are colored red and get smaller.

How to interpret the Gator Oscillator signals?

To interpret the Gator Oscillator signals, you check the condition of the histogram bars, which tells you what the Alligator is likely doing. These are the four common situations:

- Both the bars above and bars below the centerline are red and very close to the centerline – this means the Alligator is asleep, with its mouth closed.

- One of the bars, (most likely the bars below the centerline) turns green – it means the Alligator has woken up hungry and licking its lips.

- Both the bars above and below the centerline are green and expanding – this means the Alligator has opened its mouth (lips, teeth, and jaws) and is ready to eat.

- Both the bars above and bars below the centerline are red and contracting – this means the Alligator is full and no longer interested in eating, as the market starts going into consolidation.

What are the benefits of using the Gator Oscillator?

The benefits of using the Gator Oscillator includes:

- The oscillator provides a better visual representation of the behavior of the Alligator indicator

- It makes it easier for you to interpret the Alligator indicator

- It enables you to stay in tune with the market

- It helps you to see when the Alligator opens its mouth to eat profits so you can trade along and capture yours.

- It shows when the Alligator is closing its mouth, warning you to exit the market in time.

How to add the Gator Oscillator to your trading chart?

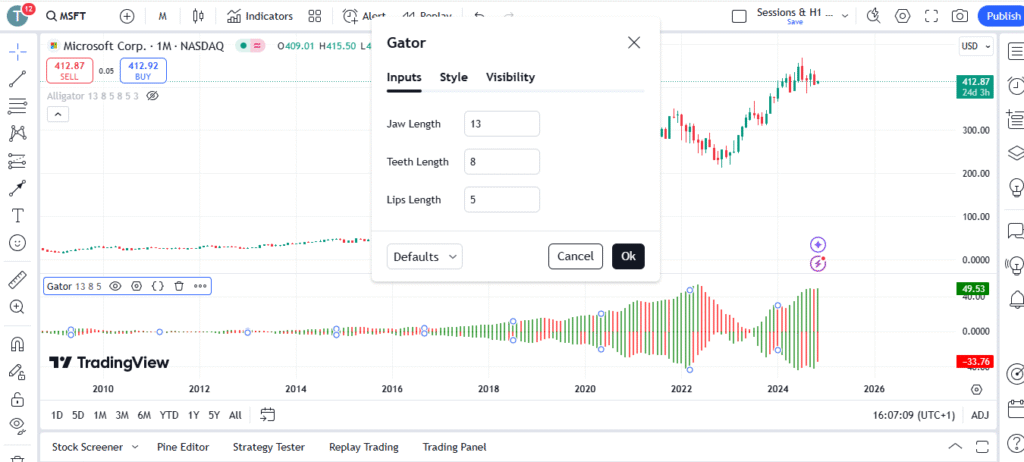

To add the Gator Oscillator to your trading chart, go to the indicator section of your trading platform and search for the indicator. It is usually one of the preinstalled indicators on most trading platforms. You simply double-click it to attach it to your chart. A settings box may pop up for you to input your preferred settings, as in the chart below:

What timeframes work best with the Gator Oscillator?

The timeframes that work best with the Gator Oscillator will depend on the trading style you are using. For instance, if you are a day trader, you will likely be trading on an intraday timeframe, such as the hourly, 30-minute, 15-minute, or 5-minute timeframe.

However, you will need to backtest your strategy on these timeframes to choose the one that offers the best performance. This also applies if you are a swing trader where you have to choose between the daily, 8-hourly, and 4-hourly timeframes.

How does the Gator Oscillator differ from other indicators?

The Gator Oscillator differs from other indicators in that it uses its unique methods to portray what is happening in the market. The oscillator is based on the Alligator Indicator and plots dual histogram bars above and below the 0.0 centerline at the same time.

This is unlike other histogram indicators, which plot bars on one side of the zero line at a time, representing periods when the indicator readings are positive and when they are negative.

Can the Gator Oscillator be used in all markets?

Yes, the Gator Oscillator can be used in all markets since it is based on the Alligator Indicator, which uses only the price data to compute its component SMMAs. All tradable financial markets display their price data, and that is the only data needed for calculating the SMMAs that make up the Alligator Indicator which is what the Gator Oscillator represents.

Thus, the Gator Oscillator can be used in any financial market, including the forex market where volume-based indicators don’t work because of a lack of volume data.

What are the common strategies for using the Gator Oscillator?

The common strategies for using the Gator Oscillator include:

- The breakout strategy: This strategy aims to enter a trade when the price breaks out of a price pattern, such as the rectangle or triangle pattern. The Gator Oscillator can be very useful here by showing what the Alligator is doing when the breakout. If the Alligator has opened its mouth when the breakout happened, the breakout is more likely to work. The opposite is the case if the Alligator is asleep.

- Trend-following strategy: This is a strategy that aims to enter a trade in the direction of the trend and hold it until the end of the trend. The Gator Oscillator can be very helpful in showing the entry and exit points.

How to combine the Gator Oscillator with other indicators?

To combine the Gator Oscillator with other indicators, you have to look for indicators that complement it so you can use them to create a robust trading strategy. One group of indicators that can complement the Gator Oscillator is volume indicators, as they can show whether the Alligator’s eating mode is accompanied by huge trading volumes.

When the eating mode is accompanied by a huge volume, it shows that the price action is healthy.

What are the limitations of the Gator Oscillator?

The limitations of the Gator Oscillator include:

- The indicator can lag the price action since it is based on smoothed moving average lines

- It can still give false signals, as it cannot accurately predict what the market will do next all the time

- It cannot directly show you how to manage risk

- It may be difficult to use it as a standalone strategy

How to customize the Gator Oscillator settings?

To customize the Gator Oscillator settings, create a trading strategy based on the indicator and backtest it. While backtesting the strategy, you experiment with different settings to find the ones that work best for the market you are trading and the timeframe you trade on.

Then, you set up the indicator with the best-performing settings from your backtesting. Also, you should periodically evaluate the performance of the strategy to know when you need to tweak the settings.

What are the best practices for trading with the Gator Oscillator?

The best practices for trading with the Gator Oscillator include:

- Using volume indicators to confirm the behavior of the Alligator

- Combining the indicator with trend indicators to trade in the trend direction

- Not using the indicator as a standalone trading strategy

- Using the indicator to confirm the momentum of a price breakout

- Trading only in the direction of the main trend

- Applying a risk management plan

How to identify trends using the Gator Oscillator?

To identify trends using the Gator Oscillator, you check whether the histogram bars are expanding or contracting. If the histogram bars are expanding, it means that the moving averages that make up the Alligator Indicator are spreading out. This indicates there is a trend but does not show the direction of the trend. You may need the Alligator Indicator itself to know the direction of the emerging trend.

What are the key signals of the Gator Oscillator?

The key signals of the Gator Oscillator are as follows:

- Expanding histogram bars: This shows that the Alligator is not only awake but has also opened its mouth to begin eating. In indicator terms, it means that the SMMAs are fanning out, showing an emerging trend. It is a signal to buy in the direction of the trend.

- Contracting histogram bars: When the histogram bars are contracting and converging to the zero line, it means the moving averages are coming together, which means that the trend is giving way to market consolidation. This is a signal to exit from the market.

How reliable is the Gator Oscillator in different market conditions?

The Gator Oscillator is reliable in different market conditions, as it shows the market behavior in each situation so you know whether to be in the market or out of the market. When the Gator Oscillator is beginning to expand, it means that the price has just broken out of a consolidation, giving rise to a new trend.

That’s the market you want to be in to profit from the price momentum. On the other hand, when the market is consolidating, the Gator histogram bars will start contracting, warning you to get out of the market.

What mistakes to avoid when using the Gator Oscillator?

The mistakes to avoid when using the Gator Oscillator include:

- Trading without a clear entry and exit strategy

- Not backtesting your strategy to be sure it has an edge in the market

- Using the indicator alone without a strategy

- Not having a proper risk management plan

How to backtest strategies with the Gator Oscillator?

To backtest strategies with the Gator Oscillator, follow these steps:

- Identify and study the markets you want to backest your Gator Oscillator strategies.

- From your market study, formulate your Gator Oscillator strategies and note the parameters or settings to backtest.

- Gather the historical data you need for the backtesting and divide the data into in-sample and out-of-sample data.

- Convert the strategies into trading algorithms if possible.

- Run your backtesting on the in-sample data and optimize with the out-of-sample data, adjusting your parameters as needed for each strategy.

- For each strategy backtested, evaluate the results

Can beginners effectively use the Gator Oscillator?

Yes, beginners can effectively use the Gator Oscillator if they know how the indicator works and what they can do with it. The first step is to learn about the indicator and the strategies they can trade with it. For instance, they can use it to create a breakout strategy. Practicing with a demo account can help them get used to the indicator and how it interacts with the market.

What are expert tips for mastering the Gator Oscillator?

Here are some expert tips for mastering the Gator Oscillator:

- Open a demo account with a broker of choice

- Create simple strategies with the indicator

- Play around with the strategies on a demo account

- Backtest the strategies that show some promise

- Follow a strict risk management plan

How does the Gator Oscillator enhance trading decisions?

The Gator Oscillator enhances trading decisions by showing you what is likely happening in the market using the Alligator analogy. When the indicator’s histogram bars are expanding, it means that the Alligator is awake and has opened its mouth to eat profits – this tells you there is an opportunity to profit in the market.

When the histogram bars are contracting, it means the Alligator is closing its mouth, telling you it’s time to get out of the market.

What resources are available to learn more about the Gator Oscillator?

The available resources for learning more about the Gator Oscillator can be found on therobusttrader.com and quantifiedstrategies.com.

Alternatively, you can read Bill Williams’ 1995 book titled, “Trading Chaos”.

How to troubleshoot common issues with the Gator Oscillator?

How you troubleshoot common issues with the Gator Oscillator will depend on your trading platform and its indicator coding methods. Check your trading platform for guidance if you have any issues with your Gator Oscillator system.