Is It Possible to Make Money Day Trading? Personal Statistics And Profits – Real Money)

The simple answer is yes, of course, it is possible to make money day trading. I have done it myself and made enough to become a F.I.R.E. But can YOU make money day trading? That depends on many factors.

I get a lot of e-mails about day trading. The typical questions are: Is it possible to make money day trading? Can you make money day trading? How to succeed in day trading?

In this article, I partially reveal my numbers to show it’s possible to make money day trading. Furthermore, I explain why you are unlikely to make money day trading. (This article was written over two years from 2011 until 2013.)

Is it possible to make money day trading?

It is possible to make money day trading but it requires a lot of systematic work. I will try to provide some hard evidence of how many people are making money day trading and how much, for good or bad.

Today, I will reveal my numbers from 2002 until May 2012.

Let’s first establish some unfortunate facts: even though it is possible to make money day trading, it’s no easy way to riches. Most likely you will find out this has been a waste of money and/or time. Other businesses have a higher and better survival rate than day trading.

Do swing trading before you do day trading

You are better off trying to swing trading before you start day trading. At least you will have the opportunity to participate in the stock market’s upward bias.

Please check out our free trading strategies to understand what swing trading is all about.

Day traders normally get wiped out quickly

I have been doing day trading since 2002 and I have witnessed a lot of turnover in people starting and quitting, but I happen to know some people who have been doing this longer than I have.

Like any business, this requires preparation and strict discipline. Surviving the 2-3 years of learning is the key to success. I am only trading stocks and I only know stock traders. No futures, options, or forex for me.

Is it possible to make money day trading? (My profit and losses from 2002 until May 2012)

Right now, I am in a dry spell. 2012 is just grinding, and I find it hard to make good money. There are several reasons for this which I will get back to later.

Let’s look at the summary of my own trading statistics from 2002. Hopefully, the numbers can give some motivation for other traders.

This is my key numbers from January 2002 to May 2012:

- In total, I have traded 2545 days

- 2182 days have been profitable (net after commissions), ie, 85,7% (2011 and 2012 make the average lower)

- Two losing months: January 2012 and April 2012

- Worst day: 16th of August 2007, 22 154 USD in losses

- Best day: 21st of April 2006, 37 246 USD in profits

- Best year: 2008 (only eight losing days that year)

- Best month: October 2008, 220 000 USD

- Total number of shares traded: almost 170 million

- Value of shares traded: approximately 5.1 billion USD

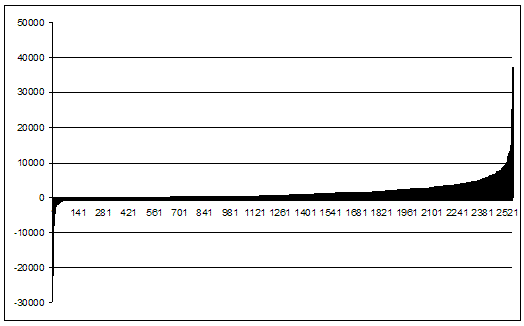

Here is a graph showing my accumulated profits since the start (number of days on the x-axis, 2002 until May 2012):

The graph illustrates why many are tempted to day trade: there is no significant drawdown, and you can make decent money out of a small deposit.

2006 and 2009 were really stellar years. I had just 15 losing days in 2006, 17 in 2007, and 8 in 2008.

During 2002 and 2003, I built my foundation, and I got to learn and get experience.

However, this graph’s conclusion is the following: The first third is nice, I love the middle third, and the last third is quite depressing.

Why do I write this? This is mainly twofold: to show others it can be done, and it motivates me to work harder and keep on looking for edges.

Some random numbers, facts, and statistics from my day trading

- Win ratio long trades: 56%

- Win ratio short trades: 52.21%

- My total profits split into long/short: long 66% of total profits and short 34%

- My total profits split into weekdays: Monday 34%, Tuesday 24%, Wednesday 6%, Thursday 11%, and Friday 25%. I can’t think of any reason why Wednesdays and Thursdays are so bad.

- Average holding time per stock: 3 hours 23 minutes and 17 seconds

- 3,24 cents profits per share traded

- Commissions and fees take 16% of my gross profits

- My most net profitable stock: SPY (Not bad, I only use SPY for hedging purposes when day trading)

- My most net cumulative profitable stock other than SPY: 3407 dollars (!). Very little, but I trade a lot of different stocks (several hundred).

- My most net unprofitable stock: -1147 dollars

- Traded 592 different stocks (my lowest number since 2001, 2002, and 2003)

- 235 stocks have a net loss

- I have 13 times as many stocks with profits above 1000 dollars than losers more than 1000 dollars.

The best days compared to total profits day trading

You want to avoid negatively skewed trading strategies. These strategies have fat left tails and might wipe out all your profits from many trades. You need to understand the distribution of your expected profits and losses. Below is my profit distribution:

When I summarized my trading from 2002 to May 2012, I looked at how much of my daytrading profits were generated from the best trading days. Before I did the analysis, I expected the “grinding” (ie. the small profits every day) to be my greatest asset in trading.

It turns out that the 1% best days equal 11% of my total profits over that ten-year period. Whether this number is big or low, I don’t know (compared to other traders), but it was smaller than I expected it to be. However, 19 of my best 25 days were in 2008, 4 in 2007, one in 2006 and one in 2005.

Here is a bar graph of all my trading days:

What can I learn about this?

- When the market conditions are favorable, I have to be there trading. No holidays are allowed. I didn’t take holidays in 2006, 2008, 2009, and 2010. In 2012, when conditions were less favorable, I traded lightly and did other things, including investing in real estate.

- When the market conditions are favorable, you have to trade size. Looking back, from 2006 until 2010 I should have traded a lot bigger size. I have to go for the jugular when the edge is there!

- BUT! Never underestimate the small profits/grinding. They do add up!

- Perhaps contradictory to point 1, but you never know when a good day suddenly shows up. 1 August 2012 was such a great day for me. I made more money that day than all my trading for 2012 until that day.

- I trade too small. My statistics are pretty good, but I have to take a greater risk. Hopefully, my new secondary income in real estate will make me a bit more aggressive.

Making money on day trading

From mid-2011 until mid-2012 I was going through a tough time trading. I hardly made any money. At the same time, I was moving to a foreign country and I had a lot of stress.

In June 2012 I did a lot of research and started different strategies. Since then I have made steady progress and been profitable all months. I’m not making nearly as much as I did in previous years, but right now I manage to make a decent living out of this.

- I traded 244 days

- 182 profitable days (75%)

- All months profitable

- Worst day: 4 254 USD in losses on 29th of May 2013

- Best day: 3493 USD on 7th May 2013

- I ended the last 5 days of June 2013 with all losses (new record)

I was not trading on two of the most profitable days (theoretically).

By writing this blog, I have come in contact with a Latvian programmer (and trader) and we’ll start trading together in August.

Hopefully, we can automate absolutely all trading, at least he has been working with a trading program for the last two months. We’ll start with three different strategies when he’s done. If this program is successful, it has paid back all the work I have put into this blog!

As of now, I’m only trading mean reversion strategies.

Automated profitable day trading

The market changed dramatically from 2011, and I have yet to cope.

I struggled in the first half of 2011, and in June 2011, it got worse when Echotrade planned to change exchange membership and unload foreign residents. I decided to leave Echo for Nevis Trading at that point. This put a hold on my trading for about two months, and I missed the great market conditions in August.

When switching broker/firm it takes a lot of time to get to know the software, routines, etc. I had issues with quotes for about four months, and I felt handicapped. This is one reason for the lower return. Also, I have moved to another country and have been very busy settling.

But I think the main reason is the widespread use of automated trading, also called “algo” trading. As far as I can see, algo trading leads to the following:

- Less volume: Medium-volume and low-volume stocks show a steady decline in share turnover.

- Thin size on the bid and ask, which means it gets difficult to put on size without moving the market. To put on 1000 shares is really difficult in stocks with 300 000 to 600 000 in daily turnover. You simply move the market.

- Very rapid changes in prices. Some stocks move very much and fast in the first 30 minutes. Yes, that could be a good opportunity, but you need good and really fast execution software to take advantage.

You either have to compete with algos or try completely different strategies that theoretically have little impact on algos. Day traders I talk to regularly mention the necessity to have software that can automate everything. As of now, I have decided to try the latter and look for strategies that have the least influence on algo trading.

However, that means I have to adapt to bigger drawdowns, which is psychologically hard. The main problem with the new strategies is that they eventually experience long periods of grinding.

From 2002 until now I have had the luxury of practically no drawdown. I am having a tough time adapting to drawdowns. It is all about psychology. Earlier I more or less only traded in the first 60 minutes of the open, now I need to trade longer and hold much longer. To generate trades I will use my old and simple API program running with Excel. That has helped me greatly, but it is no tool for fast buying and selling.

For the last two months, I have tested multiple strategies. One is implemented and has proved to be good so far. During June’s slow markets (June has always been the slowest month to me), I will implement 2-3 more.

Can you make money on day trading? Statistics from a prop firm

In general terms, I think it’s safe to conclude the following:

- The majority of day traders lose money, certainly new ones. Day traders’ turnover is very high. The longer you survive, the better your odds of making a living in the future. Personally, I know no trader who hits it off right off the bat.

- However, some surviving day traders are profitable and some very few make a tremendous amount of money day trading.

Let’s look at some facts and statistics from a failed prop firm:

Tuco Trading and the percentage of profitable traders

Tuco Trading, a professional trading firm based in San Diego, was overtaken by the SEC in March 2008. The reason was “illegal trading” in securities (I won’t go into detail about this case but this business is very regulated).

However, the court case revealed a lot about the traders’ profitability, mostly day traders. By chance, I got hold of some of the papers from the court case. One paper showed the P/L for each trader for 2007. Given that the papers are correct, they shed some light on profitability. I don’t want to publish the papers, so I’ll just summarize them, and you can make your own conclusions:

- 206 active traders per 31. December 2007.

- 33 profitable (16%).

- 173 unprofitable (84%).

- 7 with more than 50 000 USD in profits (3%).

- 57 with losses over 10 000 USD (28%).

Quite bad numbers!

Why do they fail? Here’s my take in the order of importance:

- Many lack discipline and understanding of how long it takes to learn the markets.

- They don’t have the passion and work ethic.

- Take too much risk, too extrovert.

- The markets are, in the short term, a zero-sum game. Thus, most traders can’t win.

You can’t make it with an average attitude. In a salaried position, you can do ok coming in at 8 in the morning and leaving at 4. In trading, you can, of course, work less, but you have to do what is right or correct. I do reasonably well and spend less than 5 hours a day doing this. This is solely due to my 12 years of experience.

Day trading is a struggle

I think trading is a struggle most of the time: struggle to make money, struggle psychologically to do what is right, and struggle to make decisions. Most people can’t accept this and will ultimately fail. Please read why day traders fail.

Conclusion: Is it possible to make money day trading?

Yes, but don’t expect miracles. Because short-term trading is more or less like a zero-sum game, most day traders are doomed to fail. However, if you manage to be cautious when you start out and manage to learn from your mistakes, you stand a pretty good chance of succeeding.

I spent two years being slightly positive before I managed to find some profitable edges to make it worthwhile. Patience is required to succeed.

If you want to read more about day trading, I believe these two articles might provide you with more relevant tips about day trading:

FAQ:

– How can I succeed in day trading?

Success in day trading requires patience, preparation, and strict discipline. The article recommends that aspiring day traders start with swing trading and learn from their mistakes.

– What are some common challenges day traders face?

Day traders may face challenges such as quick turnovers, steep learning curves, and potential losses if they lack the required discipline.

– What’s the difference between day trading and swing trading?

Day trading involves buying and selling financial assets within the same trading day, while swing trading focuses on holding positions for several days or weeks.

– How does Algo Trading impact day trading?

The Algo Trading has led to various changes, including less trading volume, thin bid and ask sizes, and rapid price fluctuations.

– What challenges do day traders face when competing with algo trading?

Day traders mention the need for fast execution software to compete with algo trading and the difficulty of putting on large positions without moving the market.

– What strategies can day traders use to minimize the impact of algo trading?

Day traders may consider adapting their strategies to have less influence on algo trading, but this could lead to bigger drawdowns.

– How is negatively skewed trading described, and why is it a concern?

Negatively skewed trading strategies have fat left tails, meaning they can potentially erase profits from multiple trades. This is a concern because it poses a risk to a trader’s overall profitability.

– What does the profit distribution represent in trading?

The profit distribution illustrates how profits are distributed across various trading days, helping traders analyze their trading performance.

– How does the trading approach change based on market conditions?

The approach involves trading more actively and with larger size when market conditions are favorable, as illustrated by the trading experience from 2006 to 2010.

– How can one improve their trading performance during challenging times?

To enhance trading performance during tough periods, consider conducting thorough research, implementing diverse trading strategies, and minimizing external stress factors.

– What is the significance of profitability percentages in trading?

Profitability percentages indicate the proportion of profitable trading days, reflecting the effectiveness of trading strategies. Tracking and improving these percentages is essential for consistent success.

– How can traders manage exceptionally good and bad trading days effectively?

Managing exceptional trading days, whether good or bad, requires discipline and risk management. Profits should be protected, and losses should be controlled with appropriate strategies.