Holiday Trading Strategy For Bitcoin

Traditional equity and commodity markets frequently exhibit a well-documented pre-holiday effect, where returns on trading days immediately preceding public holidays tend to outperform other days.

This anomaly is classified as one of the most substantial calendar effects in the stock market, also by QuantifiedStraregies.com. Historically, average returns on pre-holiday days can be more than ten times larger than on regular trading days.

Given that Bitcoin is often described as the archetypal absolute risk asset, it is natural to hypothesize that any calendar-driven anomalies observed in equities should manifest, or even amplify, in crypto markets.

However, the dynamics are slightly different: crypto markets are generally more dispersed, retail-dominated, and influenced by non-traditional information flows, unlike equity markets driven by institutional investors.

Behavioral finance views such calendar anomalies as departures from market efficiency, driven by sentiment and attention biases, contradicting the semi-strong form of the efficient market hypothesis.

Related reading: –Holiday trading strategies

Let’s look at some holiday research by Quantopedia.com in an article called Surprisingly Profitable Pre-Holiday Drift Signal for Bitcoin. We emphasize that we at QuantifiedStrategies.com have NOT backtested or verified the results.

Methodology And Data

When evaluating the pre-holiday drift signal, the researchers used a specific data set spanning daily closing prices of Bitcoin in the form of the BITO ETF from January 2018 to June 2025.

The selection of data was deliberately focused on the ProShares Bitcoin ETF (BITO) and its futures proxy, rather than spot Bitcoin, or newer spot Bitcoin ETFs like IBIT or GBTC.

The researchers believe that only data from 2018 onward is relevant for backtesting purposes. This date is significant because it marks the introduction of the regulated Bitcoin futures. This regulation signals a maturation point in the asset class, making subsequent trading patterns more relevant for systematic strategies.

Initial Holiday Trading Strategy (Fell Short)

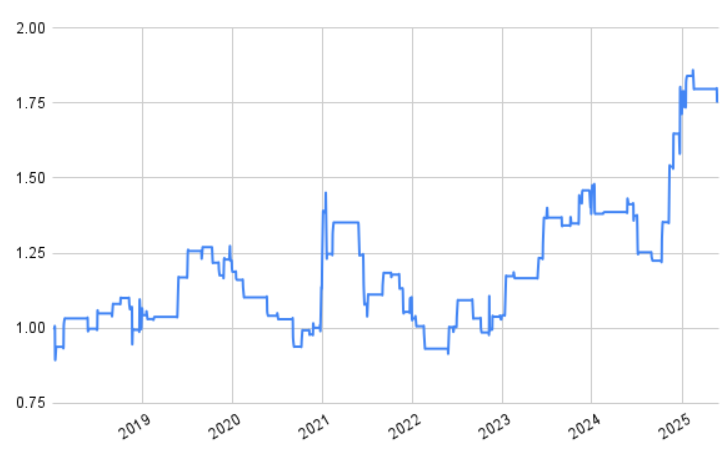

Initial investigations into a simple trading strategy, buying crypto on the day preceding the holiday (D-1), holding through the holiday, and liquidating on the close of the day after the holiday (D+1), yielded only some positive returns. The equity curve for this simple strategy was “not very satisfactory” and “tends to be flat for most of the time”.

Therefore, Quantopedia recognized the need for an additional component to enhance the strategy’s returns.

Improved Holiday Trading Strategy (Trading Rules)

The core finding of this research is that Bitcoin exhibits a pre-holiday drift similar to that in equity markets, but only when it is coupled with a short-term momentum trigger. We have previously covered many trading strategies that involve momentum for Bitcoin.

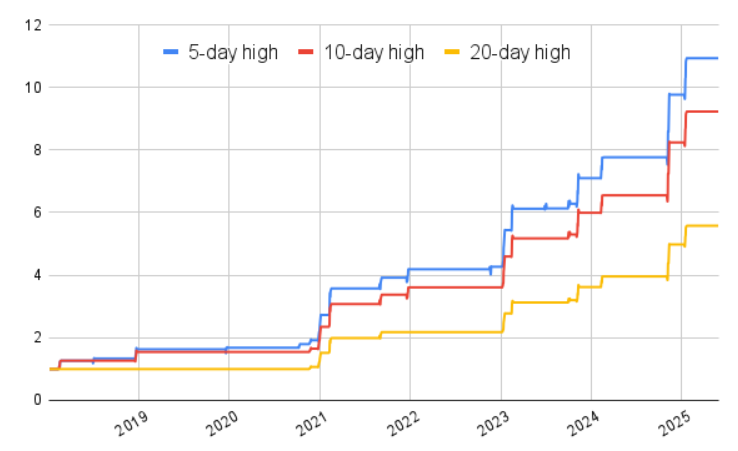

The N-day high filter defines this trigger. The research applied this filter (where N could be 5, 10, or 20 days) to identify days where Bitcoin’s closing price exceeded the maximum closing price of the preceding N trading days.

The hypothesis behind combining these two anomalies is rooted in behavioral finance:

1. Increased Retail Engagement: Around holidays, retail traders typically have more free time and are consequently more prone to engage with financial markets out of curiosity or boredom.

2. Momentum Amplification: If, during this holiday window (D-5 to D+5), prices are simultaneously breaking to new short-term highs (satisfying the N-day high condition), this technical signal captures heightened market attention.

3. Synergy: The additional attention and speculative activity from retail participants can act as fuel for further price increases. This combination of a bullish technical signal and heightened retail activity exacerbates upward moves, creating a repeatable and potentially profitable trading pattern.

The N-day high filter serves as a proxy for heightened market attention, capturing instances where participants simultaneously face discretionary trading time and positive feedback loops.

These results suggest that crypto markets are not immune to herding and sentiment biases, and these biases may even be magnified given the asset’s speculative nature and retail concentration.

Robust Returns and Attractive Risk Metrics

Once the N-day high filter is applied, the strategy’s performance improves markedly, demonstrating the compounding effect of calendar timing and momentum screening. The whole period between D-5 and D+1 shows significantly positive average daily returns when filtered.

The 10-day high variant of this filtered holiday strategy was found to offer highly attractive risk-adjusted profiles. Performance metrics for the D-5 to D+1 window showed that the 10-day variant yielded a Sharpe ratio over 2.0 and a Calmar ratio over 7.0.

There you have it! This is a pretty straightforward strategy to backtest yourself.