Is Gold An Inflation Hedge?

Is gold truly the inflation-proof sanctuary many believe it to be? While its allure as a safeguard against rising prices has long been celebrated, particularly after the turbulent 1970s, recent comprehensive analysis reveals a far more nuanced reality.

Far from being a consistent, one-to-one inflation hedge, gold’s relationship with inflation is far more complex. The findings suggest that gold is not a reliable hedge against average inflation rates; however, it effectively preserves purchasing power, vastly outperforms inflation over the long term, and exhibits a powerful reaction to large inflation rates, unexpected shocks, and critically, inflation expectations.

Ultimately, gold is labeled a “store of value” and a “super-hedge against inflation,” rather than a simple, consistent inflation hedge.

This article is a summary of Is Gold An Inflation Hedge? by Dirk G. Baur.

Related reading: Safe Haven Investments

The Myth of Gold as a Consistent Inflation Hedge

The idea of gold as a perfect inflation hedge suggests that its real prices would remain constant over time, yielding zero returns when adjusted for inflation, and that gold prices would move in a one-to-one relationship with inflation.

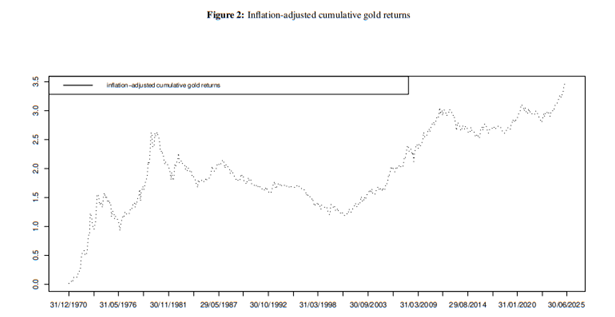

However, empirical evidence over the past five decades, from 1971 to 2025, largely refutes this notion. Real gold prices have consistently risen, rather than remaining flat.

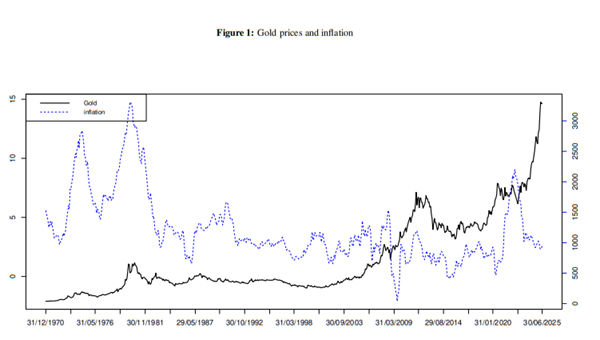

Historically, gold did act as an inflation hedge during the 1970s and 1980s. Yet, in the subsequent decades, the analysis finds no empirical evidence that gold moves consistently with inflation or reacts to it on average.

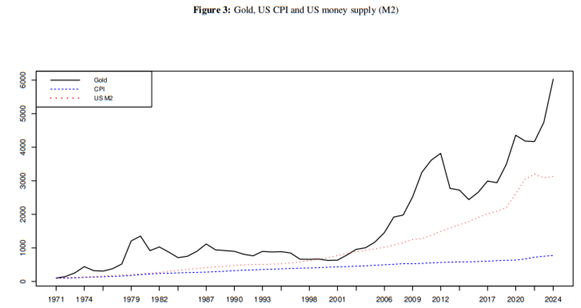

Regression analyses show that changes in the Consumer Price Index (CPI), inflation rates, money supply, and real interest rates have very low or no explanatory power over gold price movements. Even for quarterly and monthly data, these variables explain less than 3% of gold price movements, and the effects have significantly weakened or disappeared since 1998. The post-COVID spike in inflation, for instance, was not associated with any significant increase in gold prices.

Interestingly, gold has not merely hedged inflation; it has vastly outperformed inflation and money supply, leading some to suggest it could be labeled a “super-hedge against inflation”. The average annual gold price change, for instance, was about 8% compared to a mean US CPI change of 3.9% and a US inflation rate of 4.02%. This consistent outperformance means gold is not a one-to-one inflation hedge.

Gold’s Selective Reaction: Responding to Extreme Inflation and Shocks

While gold doesn’t react to average inflation, it exhibits a distinct threshold effect: it reacts strongly to large inflation rates and shocks. This behavior is akin to gold’s “safe haven effect,” where its price returns are uncorrelated with average stock market returns but become negatively correlated when stock markets experience extreme losses.

Regression results, particularly for quarterly data, indicate that gold prices react to high inflation rates (exceeding the 90% quantile threshold) but not to “normal” inflation rates. This threshold effect, however, appears to have weakened recently, possibly due to a decrease in periods of extremely high inflation.

The Impact of Inflation Expectations on Gold

Perhaps even more significant is gold’s robust reaction to inflation expectations. The study found a strong response of gold prices to both 1-year and 5-year inflation expectations, with the effect being more pronounced for annual data compared to quarterly or monthly data. For annual data, changes in 1-year inflation expectations can have an impact of about 8% on gold prices, and for 5-year expectations, this can rise to 12%.

This strong link to expected inflation, rather than realized inflation, is a consistent finding. Gold prices reacting to expected inflation means they may not need to react to realized inflation unless there is an unexpected surprise or shock.

Indeed, inflation rate changes or shocks are consistently found to yield positive and statistically significant coefficient estimates across all model specifications. Market-derived 10-year breakeven inflation rates also confirm that expectations matter, even daily, though their explanatory power for gold price changes is low.

Gold’s True Value: A Store of Wealth and Currency Hedge

If gold isn’t a consistent inflation hedge, what is its true financial role? The paper concludes that “store of value” is a more accurate label because gold preserves and stores value even as it vastly outperforms inflation.

The source also highlights that gold’s property as a currency hedge is theoretically stronger than its inflation hedge property. This is because the currency hedge is based on arbitrage opportunities that arise from gold price differences across countries or currencies.

In contrast, the incentive to buy or sell gold based on Consumer Price Index (CPI) changes is weaker because CPI is not a tradable asset. Due to the violation of Purchasing Power Parity (PPP), where exchange rates don’t fully adjust to inflation differentials, gold cannot consistently be an inflation hedge across all currencies.

Therefore, gold’s outperformance and value preservation stem from various other drivers, including its role in diversifying risk in equity and bond portfolios, its function as a safe haven asset, its strong currency hedge property, and its status as a central bank reserve asset.

Gold Investments: Key Insights

For investors, the findings suggest:

- Gold is not a reliable, consistent hedge against average or “normal” inflation rates over short or long horizons.

- It does, however, effectively preserve purchasing power and significantly outperforms inflation.

- Gold reacts strongly to periods of exceptionally high inflation and inflation shocks, similar to its safe haven response during extreme stock market downturns.

- Perhaps most critically, gold prices are highly sensitive to inflation expectations, particularly over 1-year and 5-year horizons.

- Gold’s role as a currency hedge, a diversifier, and a safe haven asset is a significant factor contributing to its value beyond its direct relationship with inflation.

Understanding these distinctions is crucial for anyone considering gold in their investment portfolio, particularly in anticipating its performance in different economic environments.