Reddit Sentiment Trading Strategy (For Crypto)

If you’ve dipped your toes into cryptocurrency, you know how wild the market can be. Unlike traditional assets like stocks, which are tied to company fundamentals, crypto prices are driven almost entirely by simple supply and demand. This reliance means that investor sentiment, the collective mood or feeling about an asset, is a significant factor in driving rapid, unpredictable shifts. Let’s look at a Reddit sentiment trading strategy.

A recent study called Forecasting Cryptocurrency Markets: An Algorithmic Approach with Reddit-Based Relative Volume and Sentiment by Rentaro Noguchi, Ashrita Mahadevu, Aariv Aggarwal, and Huifang Qin explored whether signals scraped directly from Reddit, a major hub for retail investors, could guide a consistently profitable trading strategy in this volatile environment. The answer, surprisingly, is yes, but only if you use a sophisticated system to filter the noise.

Here is a breakdown of the CARVS (Cryptocurrency Algorithm using Relative Volume Sentiment) strategy, explaining how it leveraged Reddit chatter to generate substantial profits, even when the overall market was crashing.

Related reading:

Why Reddit Sentiment is a Game Changer for Crypto

Cryptocurrency markets differ fundamentally from stock markets: they lack intrinsic value and are largely driven by retail investors. This leads to extremely high volatility; for example, Bitcoin’s average daily volatility is approximately 5.55%, nearly six times higher than that of stocks.

To navigate this landscape, researchers turned to sentiment analysis, a tool that converts textual discussions into measurable scores reflecting the communal mood toward an asset. Reddit is an ideal source because of its topic-specific communities (subreddits) and built-in endorsement indicators (upvotes).

However, initial attempts to correlate simple “sentiment polarity” (the basic positive/negative mood score) with next-day price changes showed only a weak relationship. To make Reddit chatter truly useful, the data had to be meticulously cleaned.

Cleaning Up the Noise: Making Sentiment Reliable

The researchers found that raw sentiment data was full of noise. The models used to score comments (like BERTweet) frequently struggled with informal language and sarcasm. A major issue was misattribution: the model might flag a comment as negative toward a cryptocurrency when the negativity was actually aimed at a famous public figure (like Hoskinson or CZ) or another user.

To improve accuracy and reduce noise, several post-processing steps were taken:

1. Neutralizing Misattributed Sentiment: Comments mentioning famous figures or specific Reddit slang (like “DYOR” or “ape”) were adjusted to a neutral score (0) to ensure negativity wasn’t mistakenly applied to the crypto itself.

2. Decoding Crypto Slang: Scores were manually adjusted for common crypto-specific phrases that carry inherent sentiment, such as “Moon” (skyrocket, positive), “FUD” (Fear, Uncertainty, Doubt, negative), and “HODL” (Hold On for Dear Life, positive).

3. Weighing Upvotes: The “like” system on Reddit, upvotes, was used to weigh the sentiment score. This gives greater weight to comments that represent the collective agreement of the community, amplifying reliable signals.

4. Filtering Bots: Automated accounts (bots) that function as moderators or data feeds were neutralized, as they do not reflect genuine user sentiment.

The Core Signal: Relative Volume Sentiment (RVS)

The biggest breakthrough came when the researchers realized that mood (sentiment) and activity (volume of comments) needed to be combined into a powerful hybrid metric.

They created the Relative Volume Sentiment (RVS) metric.

RVS works by calculating three things simultaneously:

1. Relative Comment Volume Change: How much discussion volume changed compared to the normal 30-day average. This captures unusual social activity.

2. Average Sentiment Polarity: The community’s mood score.

3. Relative Upvote Change: How much engagement the comments received.

Crucially, RVS is only calculated when the direction of the sentiment (mood) and the direction of the volume change (activity) align. If these two signals contradict (e.g., volume is up but sentiment is negative), the signal is considered noise and is filtered out.

This filtering process ensures that RVS reflects not just the magnitude, but the direction and credibility of the sentiment signals.

Introducing CARVS: The Rule-Based Trading Strategy

Building on RVS, the team developed a rule-based algorithmic trading system called CARVS (Cryptocurrency Algorithm using Relative Volume Sentiment). The system was designed to be easily interpretable, translating RVS scores directly into explicit buy or sell decisions, avoiding the complexity of a “black box” model.

Here is how CARVS operates daily:

• Liquidation: CARVS first sells all cryptocurrency positions from the previous day.

• Allocation Check: It examines the RVS scores for six major cryptocurrencies (BTC, ETH, XRP, BNB, DOGE, and ADA).

• Positive RVS Signal: If one or more RVS values are positive (signaling optimism-driven activity), CARVS normalizes those positive scores and allocates 100% of capital proportionally to those coins.

• Nonpositive RVS Signal (Liquidity/Safety): If all RVS values are negative or neutral, CARVS allocates no capital and remains fully liquid (meaning it holds cash) for that day.

This strategy utilizes negative RVS as a safety signal to sit out, while allocating capital to cryptocurrencies predicted to perform best using positive RVS.

The Results: Consistent Profit, Even in Bear Markets

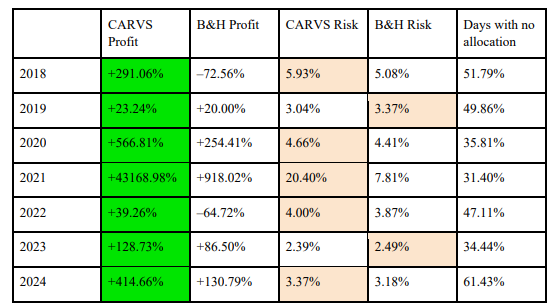

CARVS was backtested over a robust seven-year period, from 2018 to 2024, and compared against a simple Buy-and-Hold (B&H) strategy.

The results demonstrated that CARVS consistently provided value:

| Year | CARVS Profit | B&H Profit (Market Direction) |

| 2018 | +291.06% | –72.56% (Declining Market) |

| 2022 | +39.26% | –64.72% (Declining Market) |

| 2021 | +43168.98% | +918.02% (Increasing Market) |

| Overall | Outperformed B&H every year (annual returns improved by 3% to 4150% across the seven years) |

Key Takeaways:

1. Profit During Declines: CARVS was highly effective in predicting market declines, generating significant profit in 2018 and 2022, years when the standard Buy-and-Hold approach lost the majority of its initial investment.

2. Comparable Risk: The strategy managed to achieve these superior returns while generally maintaining near-equal risk (volatility) across most years compared to B&H.

3. Adaptive Strategy: CARVS adapts to market conditions. In the declining 2018 market, its success was primarily driven by avoiding allocation on predicted decline days (staying liquid 51.79% of the time). In the bullish 2021 market, its massive gains were driven by selectively allocating to the best-performing cryptocurrencies.

Final Thoughts and Limitations

This research demonstrates that social media sentiment, when meticulously processed and combined with volume data (RVS), can indeed serve as an independent, actionable market predictor in volatile cryptocurrency markets.

However, it is crucial to remember that these results are a proof of concept, not a guarantee of future profits. The backtesting simulations operated under ideal conditions, assuming no transaction costs, perfect execution, and no liquidity caps.

Furthermore, the sentiment data only reflects the specific niche sub-population on the r/CryptoCurrency subreddit and does not account for larger macroeconomic or geopolitical events that influence the market.

In essence, RVS acts like a highly sophisticated weather vane, capturing directional shifts in the community’s mood and engagement. When the wind blows strongly in one direction (positive RVS), the algorithm sails (invests). When the conditions are murky or negative, it anchors itself (stays liquid), allowing it to avoid the worst storms consistently.